Bank of Canada Rate Announcement – Oct 2022 – 0.5% increase

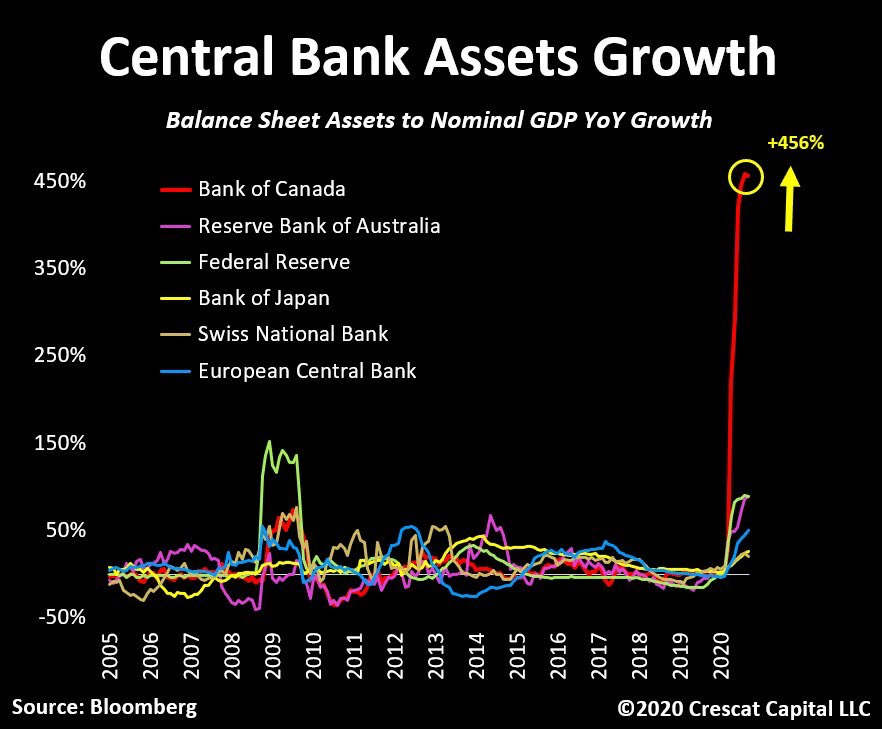

“It is our intention to let inflation run hot.” Think about that. Think about that in the context of what’s happened this year. Think about how much inflation was juiced from keeping rates ultra low & using tax payer money to buy government debt in order to help fuel spending & liquidity, then flipping a switch & causing a world of pain on avg Canadians who followed your guidance, bought homes, took out debt on the basis of rates being low well into 2023 & then forcing a recession to fix that mistake.

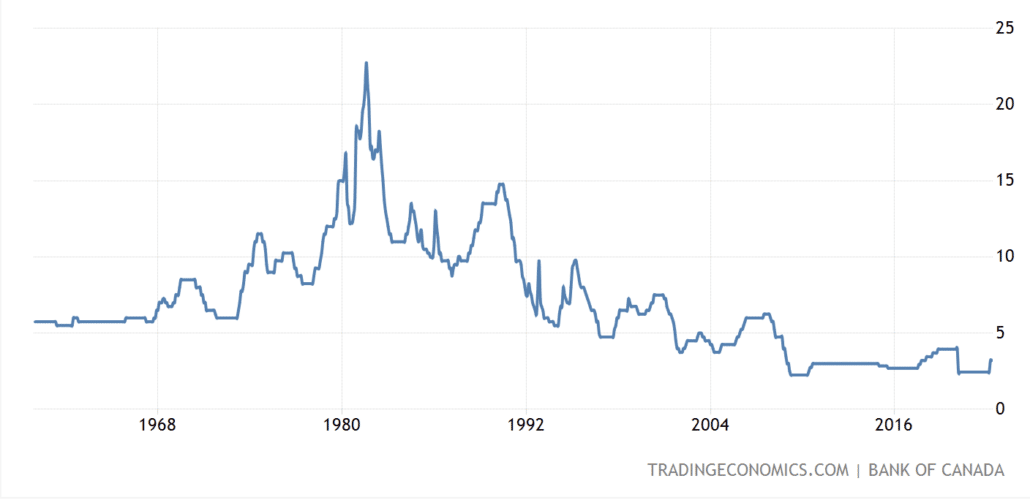

It’s hard to imagine a 50bps hike somehow being good news, but believe me, it is. Consensus was for another 0.75% hike at today’s rate announcement & the Bank of Canada for the first time since January surprised to the downside. Coming into this meeting there were 1 – 1.25% in total hikes being priced in so we will see how that plays out over the next few months & whether those expectations come down following this morning. We’re not out of the woods yet but today was a positive move for getting some eventual rate relief.

This has been an incredibly difficult central bank to read this year, going from being ultra dovish, which means, favouring low rates & easy monetary conditions, to flipping a switch in April & going on an unrelenting war path, doing everything they can to engineer the recession that we’re frankly already in. GDP is 0 & if you back out immigration it’s been negative for a while. The risk that I think we’re likely to face is, following the tsunami of demand throughout the last 2 years, all that consumption was pulled forward which leaves a void. A void that’s surrounded by higher rates & higher cost of living.

I was listening to an interview with Stan Druckenmiller last month, billionaire investor & one of the brightest financial forecasters of the last few decades, liken the US Fed (and this applies to the Bank of Canada) to a kid driving a Porsche 200 miles an hour then not just taking his foot off the pedal but slamming on the brakes. What’s happened this year is causing a lot of shakiness around the world. The UK pension system almost blew up a few weeks back, followed by credit Suisse, with problems all over Europe. The US dollar is on a wrecking path. This is not a recipe for a soft landing & there are sure to be more fireworks to come here.

What tends to happen in rate hike cycles is they slow the hikes, which we’re hopefully starting to see today, then stop hiking, then move to dropping, which is looking like mid 2023, or at least, that’s when the bond market is pricing in relief & again you have to take these things with a grain of salt because at the end of the day they are just forecasts & not reality & can change.

Inflation came in above expectations last month which drove the 0.75% hike today projection leading into today but it is still continuing to trend down since it peaked in the summer. Expectations are for that to continue with inflation softening to 3% into the later half of next year. What’s going to be interesting is the stated focus on getting inflation to 2% (never mind it hasn’t been that low since March 2021). By the Bank’s own forecast that won’t happen until 2024, although not even a year ago their forecast was for 2% inflation by this time. What are we to read from that?

The Bank ended their announcement saying they will continue to take action as required to achieve the 2% target. They also highlighted stalled growth through this year into the 2nd half of next & in the post announcement presser openly discussed the likelihood of negative growth & basically a recession in the quarters ahead. Can you envision a scenario where economic data continues to decline as they continue to raise rates? This month we’ve started to see more political backlash against these moves & intuitively it seems unnecessary, but we really don’t know.

We’re likely to see at least 1 more rate hike coming up in Dec. If you’re in a variable rate mortgage, until rates start to drop, tighten up spending, avoid major purchases, be prepared for more pain even though today was a positive move.

If you’d like to discuss any of this, please get in touch. Otherwise thanks for watching & see you in Dec.